does owing the irs affect buying a house

But as youre wrapping up paperwork for your 2017 taxes its also a good time to look at how the new Tax Cuts and Jobs Actarguably the largest overhaul of the US. If the debt-to-income ratio is drastically affected by an IRS payment plan this would affect the home buying power of your income.

When filing their taxes they may qualify to exclude all or part of any gain from the sale from their income.

. The short answer is that owing the IRS money wont automatically prevent you from qualifying for a home loan. During this process the lender looks for proof that you have a valid agreement to repay the irs. With a maximum of 45 DTI allowed your IRS payment must be no greater than 125month.

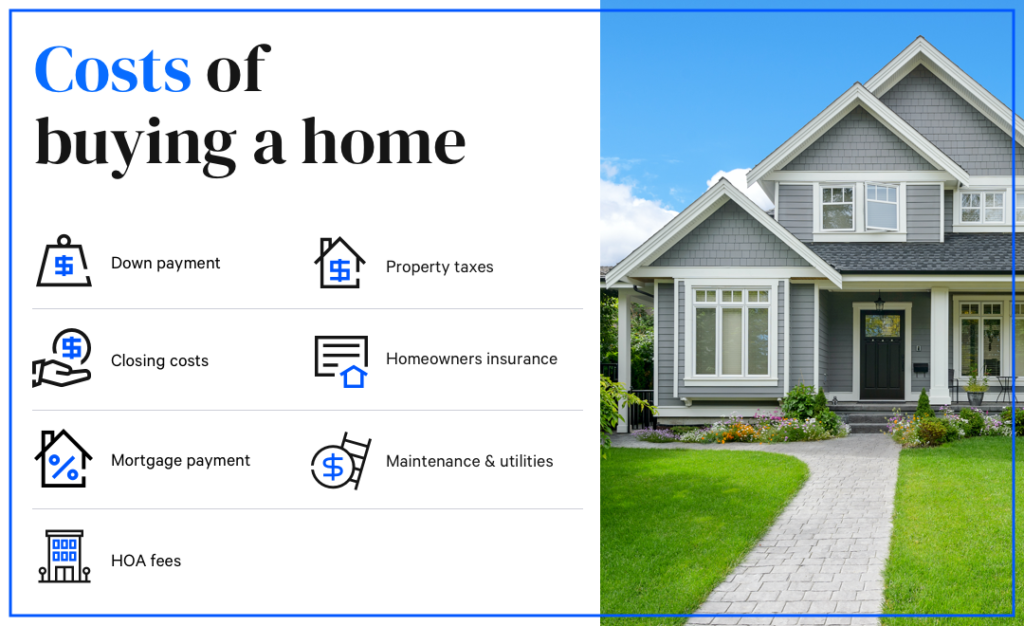

Owing taxes to the Internal Revenue Service can adversely affect your life especially if you want to buy a house. Ad 2022s Best Home Loans Rates Comparison. How does buying a house affect your taxes.

Your question is a good one and the answer to this question will depend on your options. If you cant pay the full amount you owe payment options are available to help you settle your tax debt over time. IRS Tax Tip 2021-83 June 10 2021 Its important for taxpayers to understand how selling their home may affect their tax return.

The good news is that the IRS has absolutely no authority over the lenders whose business it is to decide whether or not you are eligible to buy a home. As a first lien holder the IRSs claim to your assets supersedes all other claims making lending you a mortgage risky for the lender. If you have unpaid taxes the IRS can put a lien against your property or other assets.

Does owing the IRS affect buying a house. How does a tax lien affect buying a house. A tax lien in particular can hurt your chances of buying or selling a home.

IRS liens often take priority over a mortgage meaning the government will be paid before your lender. You can improve your chances of mortgage approval by actively working to resolve your tax debt even if you cant pay it all off immediately. Yes you might be able to get a home loan even if you owe taxes.

Potential home buyers who owe taxes to the IRS may find it difficult to obtain financing from a mortgage lender. Yes you might be able to get a home loan even if you owe taxes. So the bank may stop the approval process for a mortgage on a house if they discover a lien.

Things taxpayers should consider when selling a house Homeownership and taxes. Thankfully compared to a decade ago there are fewer IRS liens out there today due to changes to our tax laws. Things taxpayers should.

45 of 12500 equals 5625. Does Owing Taxes Affect Buying a House. The short answer is that owing the IRS money wont automatically prevent you from qualifying for a home loan.

Use Our Comparison Site Find Out Which Lender Suits You The Best. Can I buy a house if I didnt file taxes. Depending on the amount you owe it might make sense to put off buying a house for a bit while you focus on your back taxes.

Find A Lender That Offers Great Service. Owing taxes or having a tax lien does make it harder and more complicated to get a mortgage. Your employment ability to buy a house a.

A seller will receive this form if the gain on the sale of the home is not entirely excluded from income. Posted on Oct 18 2013. Compare More Than Just Rates.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. If your DTI is 44 of that monthly income before the IRS payment including the full mortgage payment your total monthly debt is 5500. The bad news is that the money you owe the IRS could impact your loan application in other ways that you havent yet anticipated.

Before you apply for a loan it is important that you understand how recent changes in the. Set up a payment plan If you cant pay off your tax debt in a reasonable amount of time youll need to set up a payment plan with the IRS. Apply Easily And Get Pre Approved In a Minute.

A tax debt doesnt equal a blanket rejection for a mortgage application. A tax debt doesnt equal a blanket rejection for a mortgage application. Does Owing Taxes Affect Buying a House.

When the IRS files a tax lien it means the IRS is letting all other creditors know that it has a debt to collect from you first. Yes you might be able to get a home loan even if you owe taxes. Owing back taxes to the IRS and getting those threatening letters.

If you have an IRS lien on your income or assets youll. The answer can depend on your particular situation. Taking steps towards debt resolution with the Internal Revenue Service is significant to your homeownership success mortgage payments and.

I would suggest that you contact a competent tax. Can I buy a house if I didnt file taxes. I would suggest that you contact a competent tax attorney or contact the IRS directly to consider your options.

Tax code since the Ronald Reagan erawill affect your taxes for 2018 and beyond. Skip The Bank Save.

Does Irs Debt Show On Your Credit Report H R Block

Can I Buy A House If I Owe Back Taxes

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

Is It Possible To Buy A House If I Owe Back Taxes

What Does Debt Look Like In America Every Generation Is Carrying Some Debt But The Amount And Cause Vary As W Finance Jobs Finance Infographic Finance Quotes

It Goes By A Rather Awkward Acronym Nftl Notice Of Filing Of Tax Lien If You Owe The Irs Money And After Their Demand You Ha Tax Debt Tax

If I Owe The Irs Can I Still Buy A House Outlet 53 Off Www Ingeniovirtual Com

Can You Buy A House If You Owe Taxes To The Irs Or State

Can You Get A Mortgage If You Owe Back Taxes To The Irs Jackson Hewitt

/ready-to-buy-house.asp_final-b6fe5f59254146af84917febd47b0a14.png)

Buying A House What Factors To Consider

What To Expect When Buying A House While Owing Taxes

Can You Buy A House If You Owe Taxes Credit Com

Can You Get A Mortgage If You Owe Back Taxes To The Irs Jackson Hewitt

Debt Consolidation Do S N Don Ts Credit Card Debt Settlement Debt Credit Debt

Can You Buy A House If You Owe Taxes Credit Com

How The Irs Tax Liability Affects Home Buyers Or Refinancing Damiens Law Firm